About the Partnership

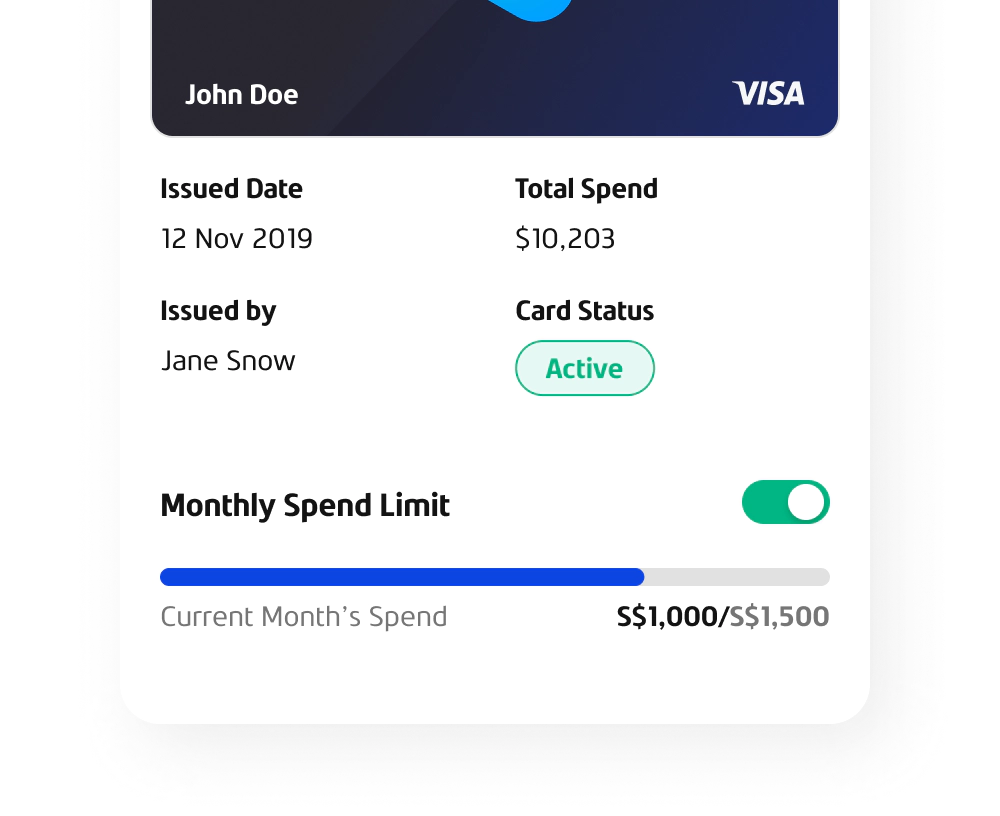

Fazz and Actum are joining forces to help Singapore SMEs access the funds they need to grow and thrive. With Fazz’s cutting-edge financial technology and Actum’s expertise in card tokenization, the partnership promises to be a game-changer for small and medium businesses in Singapore.

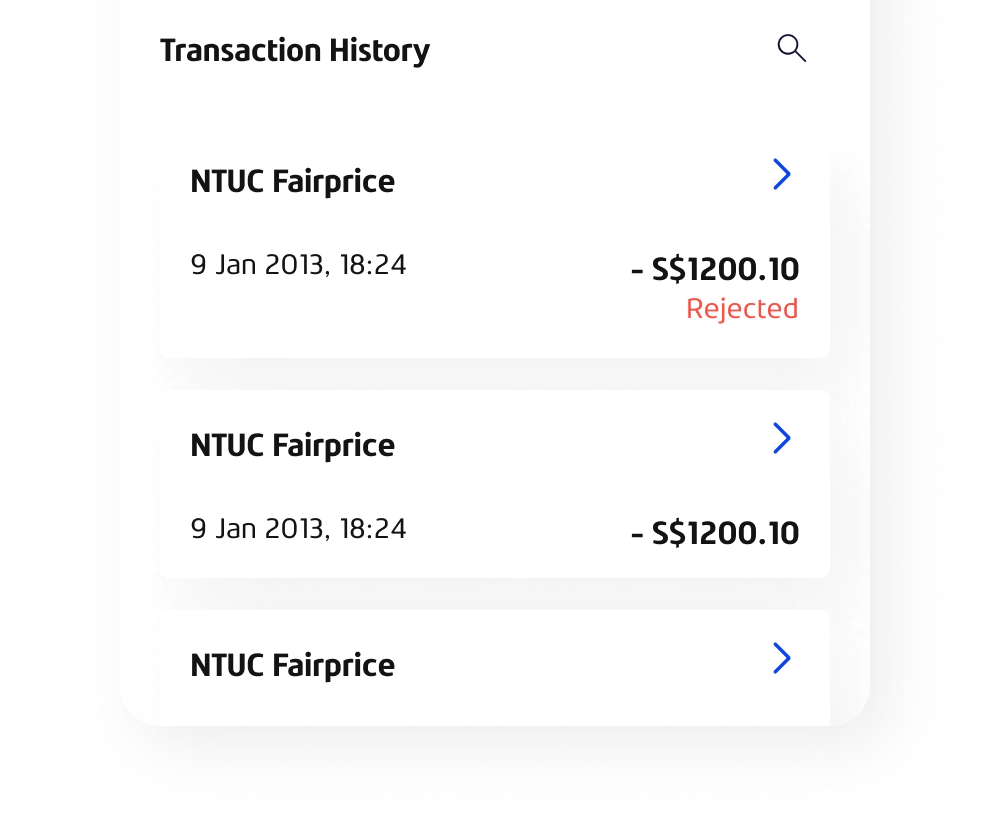

Actum is a subsidiary of Pracbiz Pte Ltd, a 22 year old B2B digital transactions management company that serves many retailers like NTUC Fairprice, Watson’s, Courts, and suppliers like Coca-cola, P&G, Unilever, DKSH, Kao, and thousands more in the modern trade business. Actum complements this by providing payment automation and facilitating credit financing for SMEs and MSMEs in general trade so that small businesses, the bloodline of the economy, continues to thrive in today’s competitive landscape.